ACC405 Project One: Everything You Need to Know

If you’re enrolled in an accounting or finance program, there’s a good chance you’ll encounter ACC405, often titled Advanced Accounting or Accounting for Governmental and Nonprofit Entities, depending on your institution. One of the most important graded assignments in this course is Project One. It plays a vital role in applying real-world accounting principles, financial analysis, and critical thinking skills.

Whether you’re feeling overwhelmed, confused, or just looking for some guidance, this article breaks down ACC405 Project One in a way that’s easy to understand. Plus, we’ve added a comprehensive FAQ section to help answer the most common student questions.

What Is ACC405 Project One?

ACC405 Project One is a practical accounting assignment designed to evaluate your ability to analyze and interpret financial data for a business or government entity. The project typically revolves around reviewing financial statements, applying relevant accounting standards, and producing a professional-level report based on your findings.

Depending on your instructor or school, the project may be centered on:

- A company’s annual financial report

- A nonprofit or government financial document

- Journal entries and consolidation worksheets

- Or even a case study with provided financial data

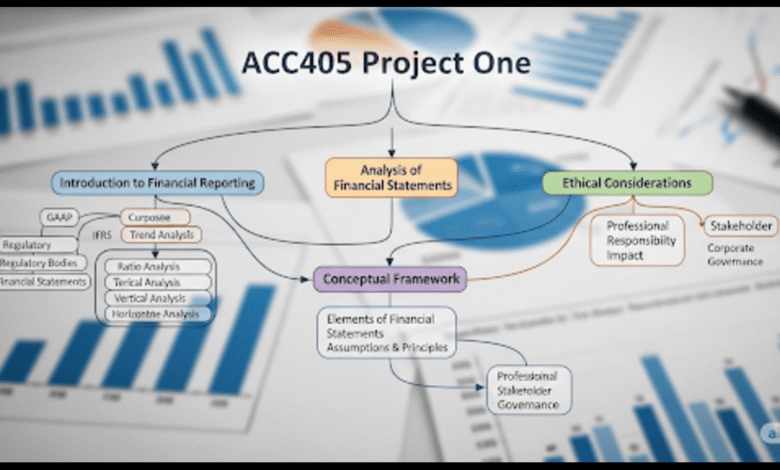

Key Components of ACC405 Project One

Although the specific structure may vary, ACC405 Project One generally includes the following elements:

1. Financial Statement Analysis

You’ll be tasked with analyzing the balance sheet, income statement, and possibly the cash flow statement. The focus may be on identifying trends, red flags, or opportunities.

2. Application of GAAP or GASB

You may need to apply Generally Accepted Accounting Principles (GAAP) for businesses or Governmental Accounting Standards Board (GASB) principles for government or nonprofit entities.

3. Journal Entries & Adjustments

In many versions of Project One, you’re asked to prepare proper journal entries for certain transactions or adjustments, including depreciation, accruals, or intercompany transactions.

4. Ethical Considerations

Some assignments include ethical decision-making scenarios, asking you to evaluate the ethical implications of financial misstatements or questionable accounting practices.

5. Written Report

Students are usually required to submit a professional report or memo summarizing their findings, conclusions, and recommendations. This section tests both accounting knowledge and communication skills.

Tips for Succeeding in ACC405 Project One

- Start Early: This project involves detailed analysis and multiple components. Don’t leave it until the last minute.

- Read Instructions Carefully: Each instructor may have different expectations. Understand the rubric before diving in.

- Use Real-World Examples: If allowed, look at actual company reports (e.g., 10-K filings) to strengthen your analysis.

- Ask Questions: Don’t hesitate to seek clarification from your professor or post in discussion forums.

- Proofread Your Report: Your report should be free of spelling and grammar issues, and it should follow professional formatting standards.

FAQs About ACC405 Project One

Q1: What is the main objective of ACC405 Project One?

A: The project’s primary goal is to test your ability to analyze financial data, apply advanced accounting concepts, and communicate your findings in a clear, professional manner. It bridges classroom theory with practical application.

Q2: How long should the report be?

A: It depends on your school’s requirements, but most reports range between 3 to 7 pages, not including financial worksheets, charts, or appendices. Always check your instructor’s guidelines.

Q3: Can I use Excel for the calculations?

A: Yes, in most cases, you’re encouraged to use Excel for calculations, financial ratio analysis, and creating charts. Some instructors may require that you submit your spreadsheet along with your written report.

Q4: Is the project based on real companies or fictional ones?

A: It varies. Some assignments use publicly traded companies (like Apple, Amazon, or Tesla), while others use fictional case studies. Make sure you’re using the correct data set provided in your assignment.

Q5: What accounting topics should I review before starting?

A: You should be comfortable with:

- Consolidations and mergers

- Government and nonprofit accounting

- Fund accounting

- Financial ratio analysis

- Journal entries and adjustments

- Ethics in accounting

Q6: How much is the project worth in the final grade?

A: Typically, ACC405 Project One is worth between 15% to 30% of your final grade, making it a critical assignment to complete with care and precision.

Q7: Can I work with a partner or group?

A: Usually, this is an individual assignment, but some instructors may allow limited collaboration. Always verify what’s permitted to avoid academic integrity issues.

Q8: What are common mistakes students make?

A:

- Misreading financial statements

- Forgetting to cite sources

- Using outdated accounting principles

- Ignoring ethical dimensions

- Poorly formatted or unclear reports

Final Thoughts

ACC405 Project One may seem daunting at first, but it’s an excellent opportunity to showcase your accounting expertise in a real-world context. By understanding the project structure, using the right tools, and managing your time well, you can complete it successfully—and maybe even enjoy the process.

Accounting is more than numbers; it’s about interpretation, strategy, and ethical responsibility. Treat this project not just as an assignment, but as a glimpse into your future profession.